Which of the Following Best Describes a Monte Carlo Simulation

Consider the following three valuation problems Problem 1. Which of the following best describes a Monte Carlo simulation.

Monte Carlo Simulation Example And Solution Projectcubicle

Run a simulation for each of the N inputs.

. Value an out of-the money put option on an asset that has. Measure the value-at-risk VaR for the portfolio of these assets based on the simulated outcomes. MCS is best described as a way of estimating uncertainty in a model and it works really well in nonlinear and chaotic models.

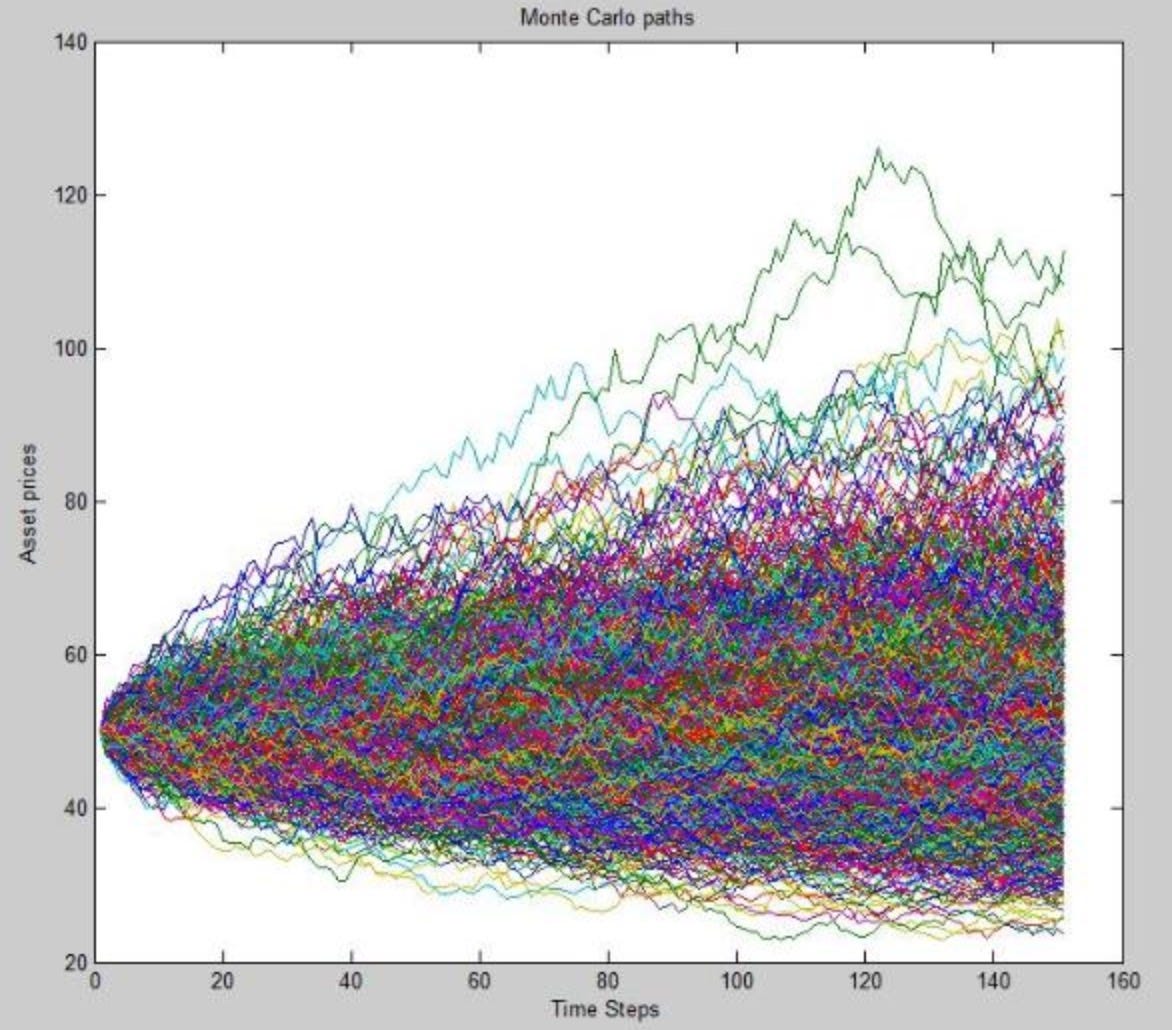

In this module youll learn to use spreadsheets to implement Monte Carlo simulations as well as linear programs for optimization. Different iterations or simulations are run for generating paths and the outcome is arrived at by using. Randomly generate N inputs sometimes called scenarios.

A Monte Carlo simulation is a model used to predict the probability of different outcomes when the intervention of random variables is present. Refers to any method that randomly generates trials but does not tell us. This includes analyzing business processes and methodologies including our own.

The system may be a new product manufacturing line finance and business activities and so on. The simulation uses a mathematical model of the system which allows you to explore the behavior. This method is used by the professionals of various profiles such as finance project management energy manufacturing engineering.

Value an at-the money call option on an asset that has non-normal returns Problem 3. Though the simulation process is internally complex commercial computer software performs the calculations as a single operation presenting results in simple graphs and tables. 1 Which of the following best defines Monte Carlo simulation.

Monte Carlo simulations help to explain the impact. It is a tool for building. Which of the following is best described as software that prioritizes and schedules requests and then distributes them to servers based on each servers current load and processing power.

Monte Carlo simulation involves the following stepsI Step 1. A Monte Carlo simulation is a quantitative analysis that accounts for the risk and uncertainty of a system by including the variability in the inputs. OCW is open and available to the world and is a permanent MIT activity.

Monte Carlo simulation is a technique used to study how a model responds to randomly generated inputs. Monte Carlo simulation is a shape calculator that generates probability distribution shape of system output performance metrics based on probability distribution of system inputs. It typically involves a three-step process.

B It is a collection of techniques that seeks to group or segment a collection of objects into subsets. Monte Carlo Simulation is a mathematical technique that generates random variables for modelling risk or uncertainty of a certain system. Simulate thousands of valuation outcomes for the underlying assets.

Red teaming is about challenging an organization. Monte Carlo or Multiple Probability Simulation is a statistical method for determining the likelihood of multiple possible outcomes based on repeated random sampling. It is known that there will be fixed production costs of 10000.

The random variables or inputs are modelled on the basis of probability distributions such as normal log normal etc. Red Teaming and Monte Carlo Simulations. This method is applied to risk quantitative analysis and decision making problems.

There are a number of advantages and disadvantages to Monte Carlo simulation MCS. MIT OpenCourseWare is a web-based publication of virtually all MIT course content. Since most complex simulations are implemented on digital computers a rudimentary acquaintance with computer programming will probably be an asset to the readers of this book though no computer programs are included Chapter 1 describes concepts such as systems models and the ideas of Monte Carlo and simulation.

From the lesson. Monte Carlo simulation is a computerized mathematical technique to generate random sample data based on some known distribution for numerical experiments. Monte Carlo simulations can be a useful tool to uplevel your red teaming skills and provide a different and fresh perspective for highlighting discussing and presenting findings.

They have provided you with the following information. Simulations are run on a computerized model of the system being analyzed. Monte Carlo simulation is a computerized mathematical technique that allows people to account for risk in quantitative analysis and decision making.

Youll examine the purpose of Monte Carlo simulations how to implement Monte Carlo simulations in spreadsheets the types of problems you can address with linear. The company want to choose the batch size that will maximise their profits. Which of the following statements most accurately describe an appropriate step in the Monte Carlo MC approach for measuring risk.

Value an in-the money call option on an asset that has normal returns Problem 2. Monte Carlo simulation is a statistical technique by which a quantity is calculated repeatedly using randomly selected what-if scenarios for each calculation. First of all though we need to understand what MCS is.

In order to help them make the right decision they have asked you to perform a Monte Carlo simulation analysis of the expected profits. It plays a crucial role in analyzing risks and solving probabilistic problems allowing businesses investors scientists and engineers to predict the range of results expected out of an uncertain situation. C Neither I nor II.

The technique is used by professionals in such widely disparate fields as finance project management energy manufacturing engineering research and development insurance oil gas transportation and the environment. A Monte Carlo simulation allows an analyst to determine the size of the portfolio a client would need at retirement to support their desired. The idea is that if we know there are a number of components going into a model and those.

Question 29 4p describe Monte Carlo simulation. A It is a tool for building statistical models that characterize relationships among a dependent variable and one or more independent variables. Which of the following best defines Monte Carlo simulation.

Monte Carlo Simulation Pan European Website Data Science

An Overview Of Monte Carlo Methods By Christopher Pease Towards Data Science

Comments

Post a Comment